- Japanese pension system

- National Pension

- National Pension benefits

- Employees' Pension

- Employees' Pension benefits

- If you return to your country before receiving your pension (lump-sum withdrawal payment)

- Consultation for pension in foreign languages

Japanese pension system

A pension is a system in which you receive money (= pension) to support your life when you get old or have health problems.

The national pension system consists of the “National Pension (kokumin nennkin)” and the “Employees' Pension (kosei nennkin)”.

In Japan, those who are between the ages of 20 and 59 must be enrolled in the National Pension.

Those who work for companies are enrolled in the Employees' Pension in addition.

Those foreign national residents who reside in Japan must be enrolled, too.

However, foreigners from countries that have a special agreement with Japan called "International Social Security Agreement" may not be required to be enrolled.

Japan Pension Service: What is a social security agreement? (English)

National Pension

The members of the National Pension are categorized into three types.

[Business owners, self-employees, students, etc.]

These individuals must be enrolled in the National Pension.

The enrollment is processed at the local municipal office.

The pension contribution is 16,980 yen per month for the fiscal year 2024 which is from April 2024 to March 2025. The contribution is in the same amount for everyone.

Pension contributions can be paid in the following ways:

- By direct debit (a payment method that automatically withdraws money from your bank account) or credit card.

- By in-person payment at banks, post offices and convenience stores while using the “payment slip” sent from the Japan Pension Service.

[Workers of companies, etc.]

These individuals must be enrolled in the National Pension and Employees' Pension.

The enrollment is processed through their employer.

[Dependent spouses of members of employees’ pension]

These individuals enroll in the National Pension only.

The enrollment is processed through the spouse’s employer.

The pension contributions are not required.

The following individuals can consult with your local municipal office:

- Those who have financial difficulty to pay pension contributions due to reduced wages, unemployment, etc.

- You may be eligible for a payment reduction or exemption.

- Alternatively, you may be able to postpone your payment due date.

- Those who are expecting a childbirth or had a childbirth

- You are not required to pay pension contributions for 4 months from the previous month of the expected childbirth date or actual childbirth date.

- Students at high schools, universities, vocational schools, etc.

- There is a program that you can postpone pension contribution payments.

- Students who earned money more than the certain amount from part-time jobs in the previous year are ineligible for this program.

Qualified schools for this program are listed at the following website:

Japan Pension Service: List of qualified schools for special payment for students (Japanese)

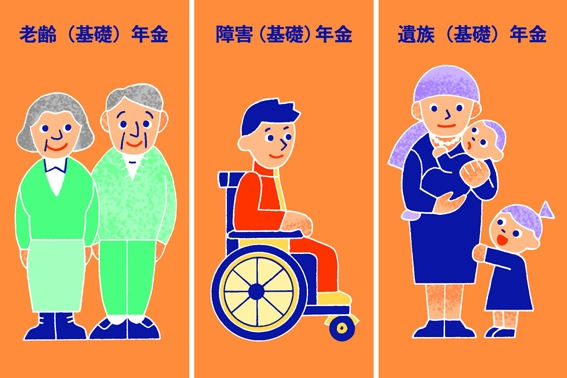

National Pension benefits

Benefits of the National Pension are the following:

[Old-Age Basic Pension "老齢年金"]

This is a benefit to support life in old age.

Those who have paid pension contributions for 10 years or more can receive it from the age of 65.

Even if you don't reside in Japan at the age of 65, you can receive this benefit.

The benefit amount depends on how long you had paid contributions.

[Disability Basic Pension "障害年金"]

This is a benefit to support life when becoming disabled due to an accident or illness.

The benefit amount depends on what kind of disability and whether you have children.

[Survivors’ Basic Pension "遺族年金"]

This is a benefit to support the life of the dependent family members of a deceased person.

The spouse of a deceased person who is raising children under the age of 18 can receive this benefit.

Ask your local municipal office or pension office for more details.

Employees' Pension

The Employees' Pension is a pension for those who work for companies, etc.

There are conditions such as working 20 hours or more per week and having a monthly salary of 88,000 yen or more.

The enrollment is processed through the employer.

Those who are enrolled in the Employees' Pension also must be enrolled in the National Pension through the Employees' Pension system.

This procedure is also done by the employer.

The employee pays half of pension contributions and the employer pays the other half.

The contribution amount is determined by the employee’s salary.

The employer will deduct pension contributions from the employee’s salary.

Employees' Pension benefits

Benefits of the Employees' Pension are “Old-age Employees' Pension”, “Disability Employees' Pension”, and “Survivors' Employees' Pension.”

Those who have been enrolled in the Employees’ Pension can receive the additional benefit from the Employees’ Pension together with the benefit from the National Pension.

Ask your local municipal office or pension office for more details.

If you return to your country before receiving your pension (lump-sum withdrawal payment)

If a foreigner who has been enrolled in a Japanese pension returns to his/her home country before receiving the benefit, he/she can receive a “lump-sum withdrawal payment.”

Those who meet all the following conditions can receive this lump-sum payment:

- No longer has an address in Japan and withdrew from Japanese pension.

- Paid contributions for the National Pension or Employees' Pension for more than 6 months.

- Paid contributions for 9 years and 11 months or less

- Have not received benefits from "disability pension."

The Lump-sum Withdrawal Payments is explained in foreign languages (14 languages) at the following website:

[How to receive the Lump-sum Withdrawal Payment]

You need to send a document called “Lump-sum Withdrawal Payment claim” to the Japan Pension Service within two years since you no longer have an address in Japan.

You can download the Lump-sum Withdrawal Payment claim form in foreign languages (14 languages) at the following website:

Japan Pension Service: “Lump-sum Withdrawal Payments” details/application form (Japanese)

[Things to be aware of a Lump-sum Withdrawal Payment claim]

If you receive a lump-sum withdrawal payment, the period in which you had paid pension contributions in Japan will be reset to zero.

Those who may wish to live in Japan again in the future and receive a Japanese pension should consider well to claim.

Also, those who are from a country that has a special agreement with Japan called an "International Social Security Agreement", should consider which of the following is better:

- Receive a lump-sum withdrawal payment.

- Receive your benefit in your home country based on the sum of the period you paid contributions in Japan and the period you paid contributions in your home country.

Consultation for pension in foreign languages

You can consult at the pension office with an interpreter service.

Japan Pension Service: Interpretation service (10 languages)